VEBLEN, THORSTEIN.

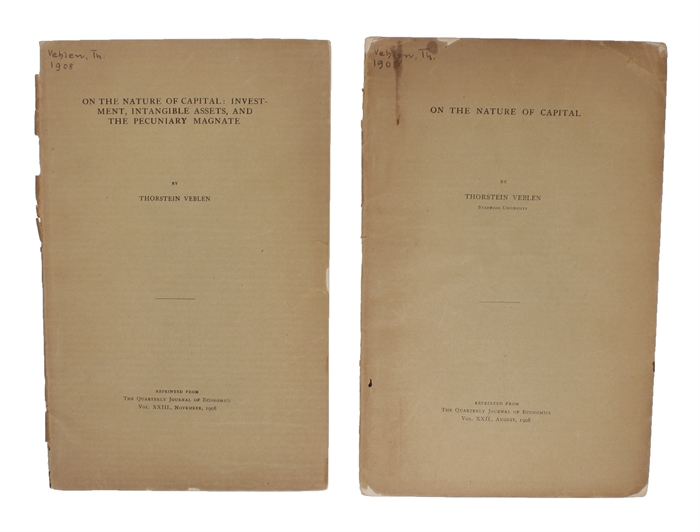

On the Nature of Capital (+) On the Nature of Capital: Investment, Intangible Assets, and the Pecuniary Magnate.

(Boston, Stanford University Press), 1908. 8vo. Two offprints in the original printed wrappers. Offprints from "Quarterly Journal of Economics", Vol. XXII, August & Vol. XXIII, November 1908. Vol. XXII: Backwrapper detached, a few small nicks to extremities. Vol. XXIII: Front wrapper detached. Fine and clean. Pp. 517-42; Pp. 103-136.

Two scarce offprints of Veblen's important publications on the theory of capital. Here Veblen broadens the concept of capital to include the capital of knowledge. Thus, Veblen's theory laid "the foundation for a system of property rights created to enable individuals to productively utilize knowledge that resides within the community as a whole" (Niman, Henry George and the Development of Thorstein Veblen's Theory of Capital).

"The foundation of Veblen's theory of capital is rooted in the special position knowledge holds in society. Knowledge forms the basis for the productive use of natural resources and is a community asset that, at its most fundamental level, is not owned by a single individual. Thus, Veblen's theory begins by laying the foundation for a system of property rights created to enable individuals to productively utilize knowledge that resides within the community as a whole. These property rights make it possible for the creation and ownership of capital in the form of industrial equipment. With growth in the scale and scope of the community comes the ability to monopolize a portion of the community's asset for pecuniary gain. Monopolization then leads to a form of economic servitude that is similar to slavery." (Niman, Henry George and the Development of Thorstein Veblen's Theory of Capital).

In contrast to conventional theories of capital that are founded on the productive labor of workers and described in individualistic terms, Veblen believed that the history of humanity is not the story of a collection of independent individuals, but, rather, is based on the collective contribution of the group. The group plays an important role because it is the group that forms the entity where knowledge is

captured and stored.

"Thorstein Veblen's theory of capital as an important element in developing an evolutionary economics warrants a closer investigation into the origins of the concept. In his essay outlining the basic theory of capital, Veblen (1908) makes explicit reference to the single taxers, and to the relationship between land as an unearned source of rent and the returns associated with capital.

If one considers Veblen's anthropological approach to economics, then it becomes easier to see how, as society develops, capital in the form of community-based knowledge takes on the fundamental role previously played in an earlier era by land. Veblen's theory of capital does not invalidate the earlier focus on land, but, rather, is one step further down the path of economic development." (Niman, Henry George and the Development of Thorstein Veblen's Theory of Capital).

Thorstein Bunde Veblen was an American economist and sociologist, and regarded as being the founding figure of the institutional economics movement. "He studied economics under John Bates Clark, a leading neoclassical economist, but rejected his ideas. He did his graduate work at Johns Hopkins University under Charles Sanders Peirce, the founder of the pragmatist school in philosophy, and at Yale University under laissez-faire proponent William Graham Sumner. He repudiated their views as well. Veblen did not reject economists' answers to the questions they posed; he simply thought their questions were too narrow. Veblen wanted economists to try to understand the social and cultural causes and effects of economic changes." (The Concise Encyclopedia of Economics).

Order-nr.: 48625